Irs 2024 Schedule Se – The Internal Revenue Service has announced that income tax brackets and standard deductions will be changing come the 2024-2025 season. The IRS released the information Thursday in its annual . That could provide a break to some taxpayers on their taxes in 2024. The tax agency on Thursday said it’s adjusting the tax brackets upwards by 5.4%, relying on a formula based on the consumer .

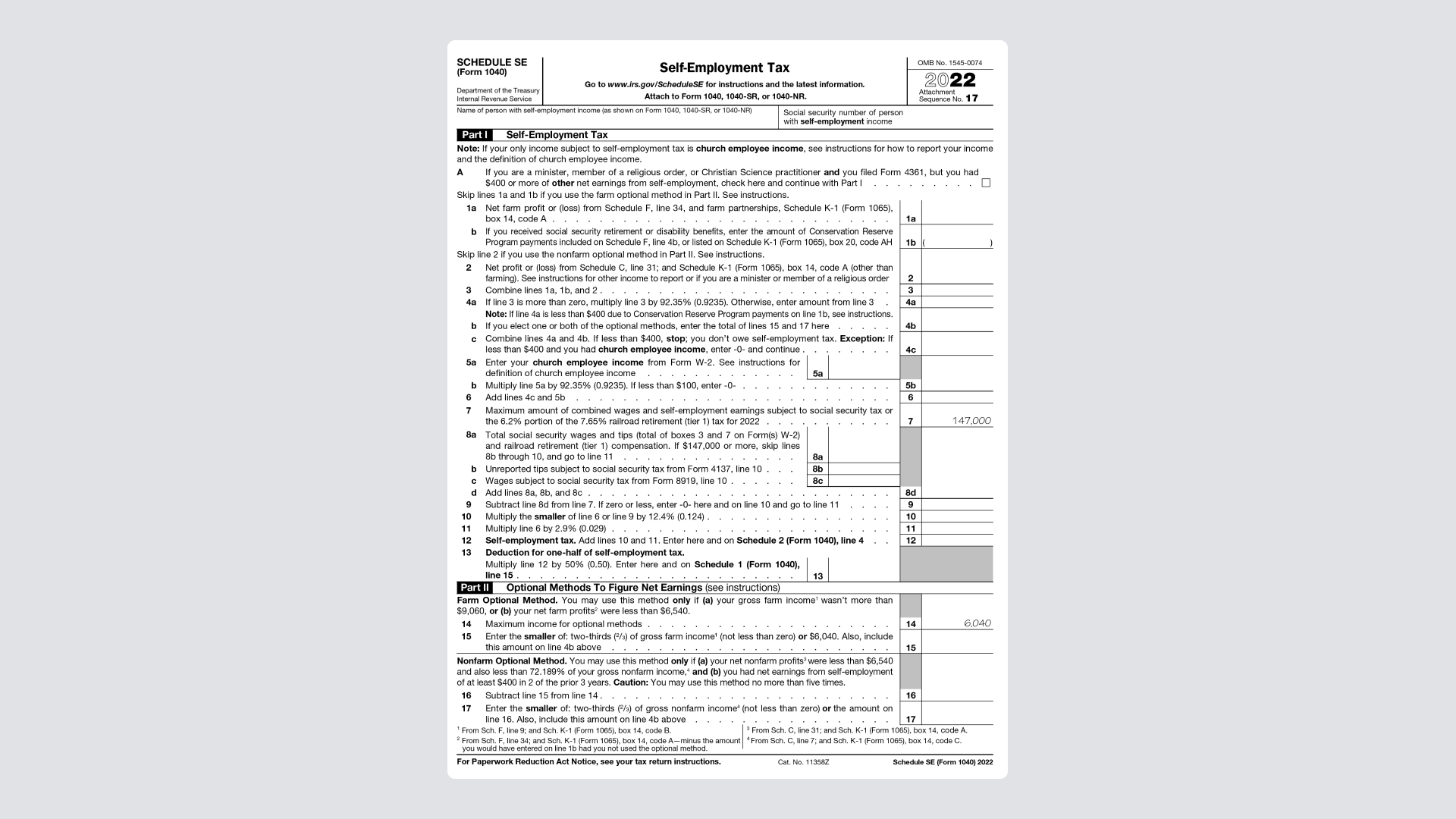

Irs 2024 Schedule Se

Source : found.com

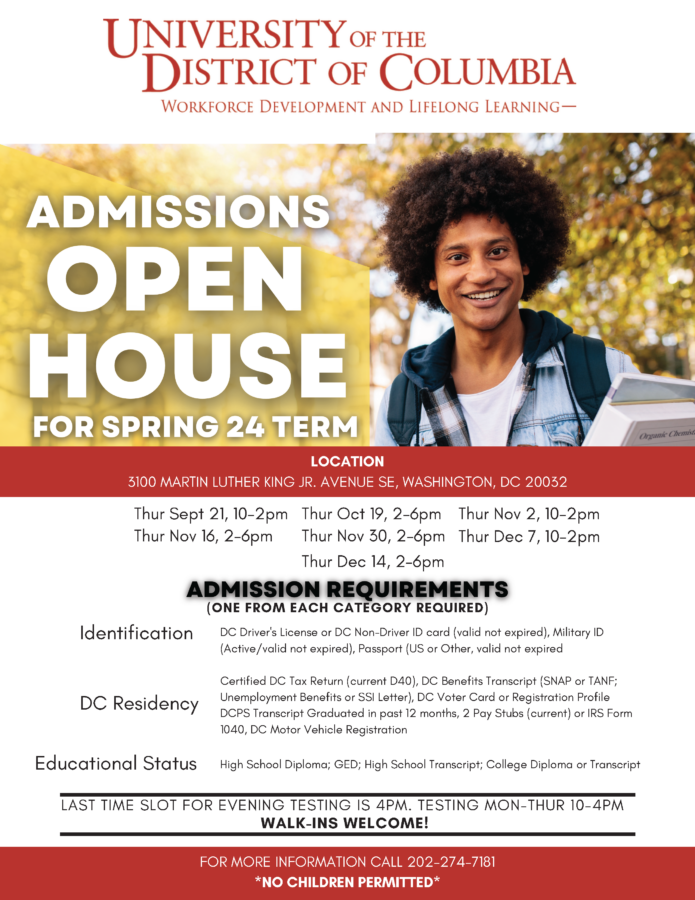

How to Apply and Enroll | University of the District of Columbia

Source : www.udc.edu

AJM Associates, Inc. | New Baltimore MI

Source : www.facebook.com

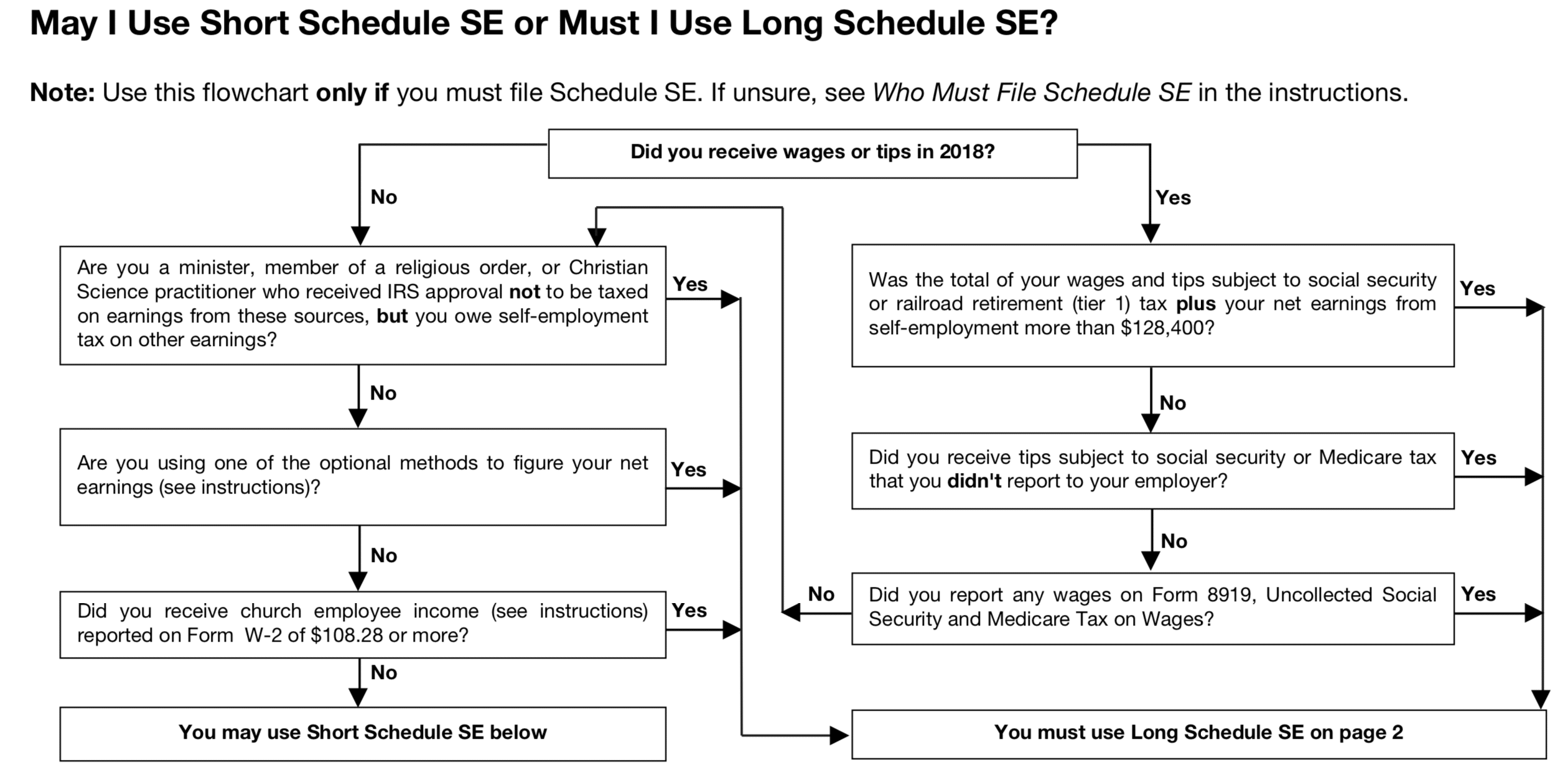

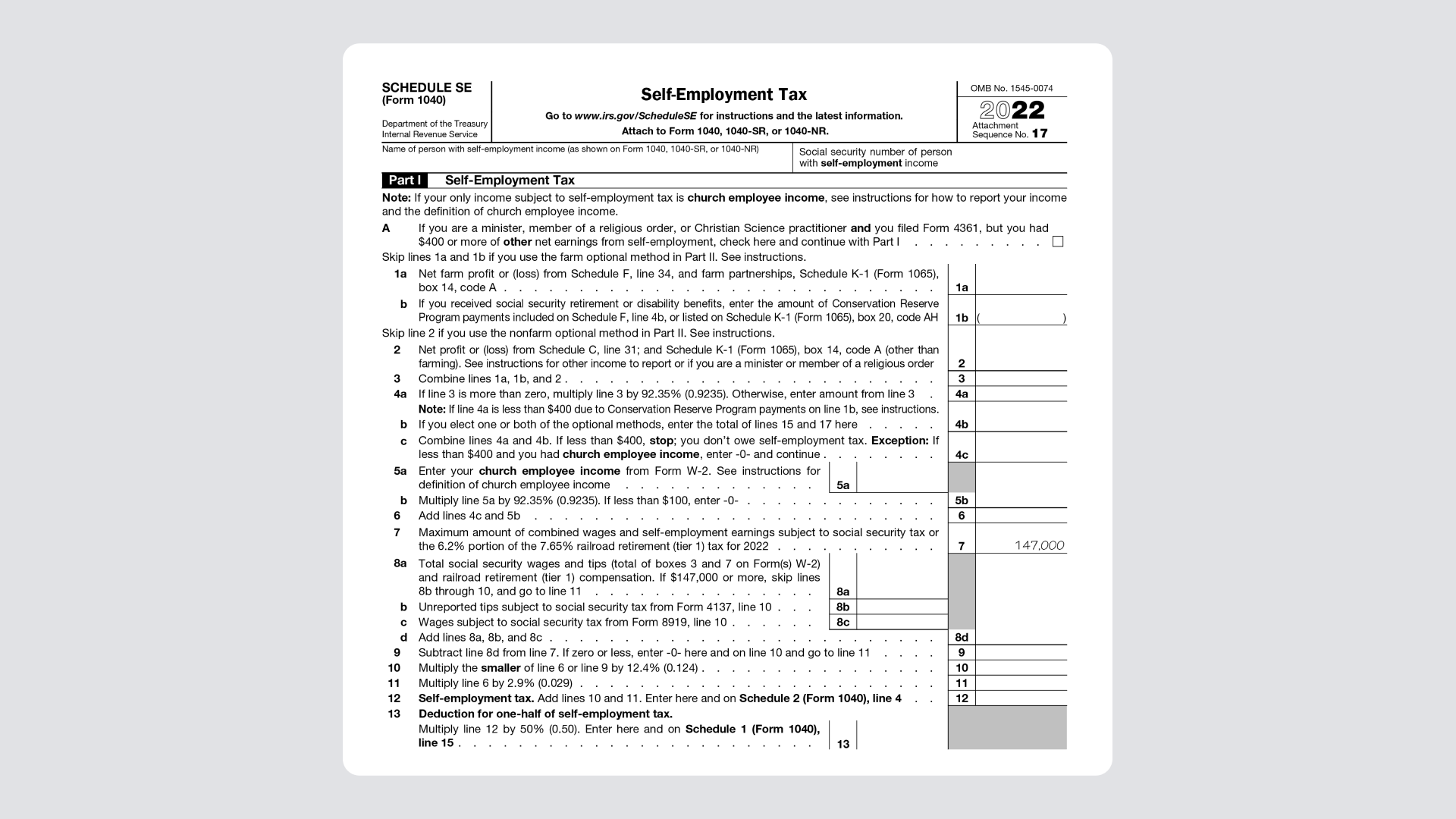

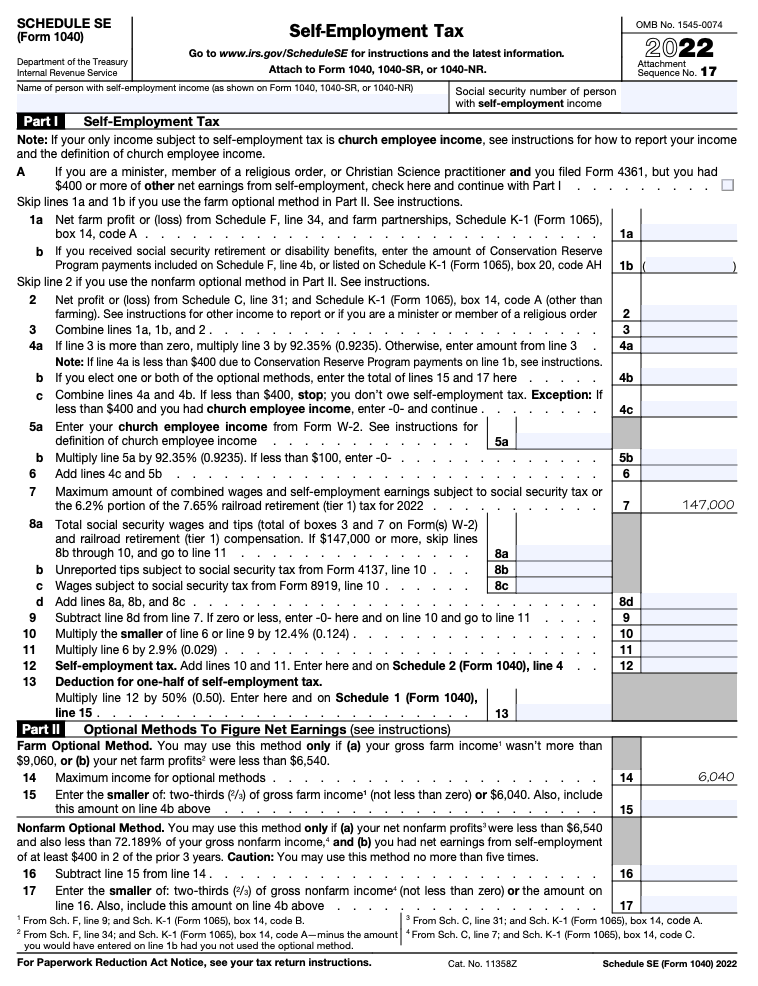

What Is Schedule SE? The Tax Form For The Self Employed

Source : thecollegeinvestor.com

A Step by Step Guide to the Schedule SE Tax Form

Source : found.com

What Is Schedule SE? The Tax Form For The Self Employed

Source : thecollegeinvestor.com

3.11.13 Employment Tax Returns | Internal Revenue Service

Source : www.irs.gov

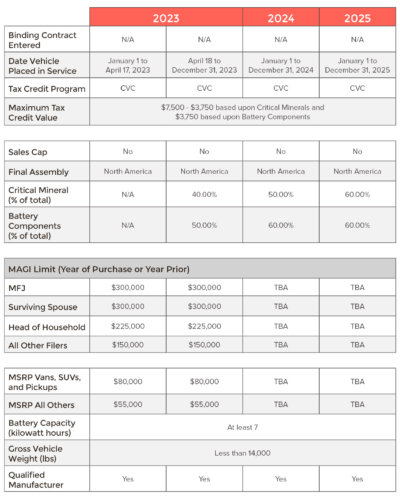

2023 Year End Tax Guide for Individuals

Source : aldrichadvisors.com

Schedule SE walkthrough (Self Employment Tax) YouTube

Source : www.youtube.com

Paying self employment taxes on the revised Schedule SE Don’t

Source : www.dontmesswithtaxes.com

Irs 2024 Schedule Se A Step by Step Guide to the Schedule SE Tax Form: From 2024, the lowest tax rate of 10 percent will apply to those earning up to $11,600, up from $11,000 this year. Meanwhile the highest rate of 37 percent will now apply to workers whose . In other words, someone with $100,000 in taxable income in 2024 would fall into the 22% bracket, but would owe a tax bill far below $22,000. Get your tax years straight Tax years can get confusing. .